us germany tax treaty interest income

You claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30 rate. It is based on model income tax treaties developed by the Department of the Treasury and the Organization for Economic Cooperation and Development.

Germany United States International Income Tax Treaty Explained

Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

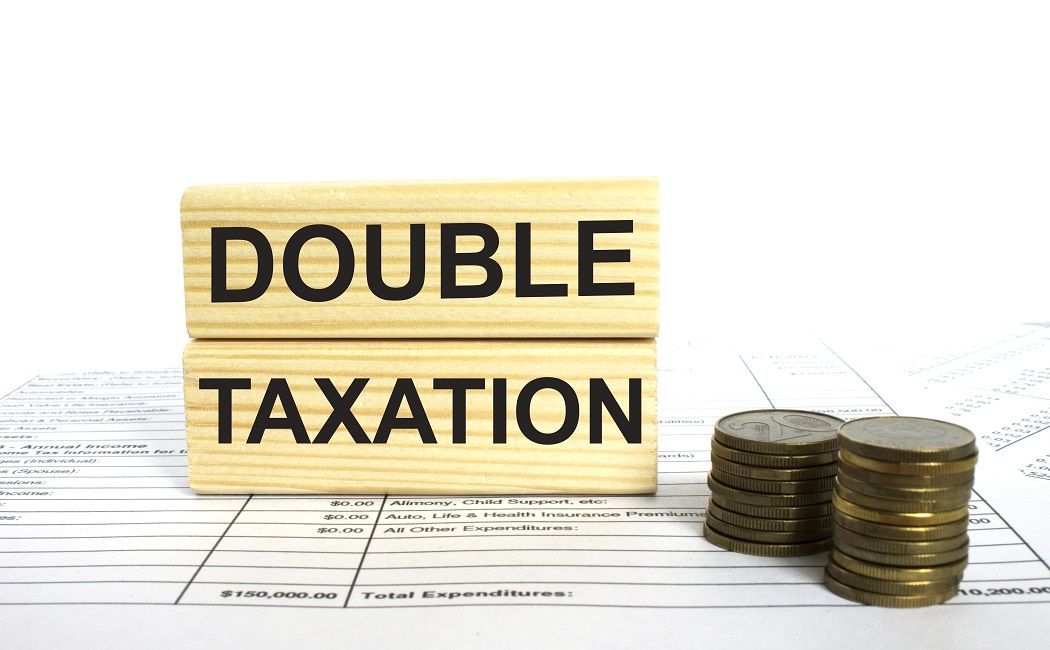

. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. Corporate recipients of dividend and interest income interest on convertible and profit-sharing bonds can apply for refund of the tax withheld over the corporation tax rate of 15 plus solidarity surcharge regardless of any further relief available under a treaty. The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax.

Germany - Tax Treaty Documents. The complete texts of the following tax treaty documents are available in Adobe PDF format. 3 Relief From Double Taxation.

Article 11-----Interest Article 12-----Royalties. It does however stipulate that income from interest dividends and royalties will only be taxed in the country where youre a resident so if you have this type of income it may be beneficial for you to claim a treaty provision when you file. The treaty has two main goals.

2 Saving Clause and Exceptions. And bb the excise tax imposed on insurance premiums paid. 8 Exchange of Information.

The purpose of the Germany-USA double taxation treaty The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double taxation on income earned by US and German residents who do business in both countries. 9 Golding Golding. And second the treaty helps to promote residents of either country from avoiding taxes.

Earnings will be taxed as normal capital income dividends interests capital gains. A In the United States. Corporate Income Tax Rate.

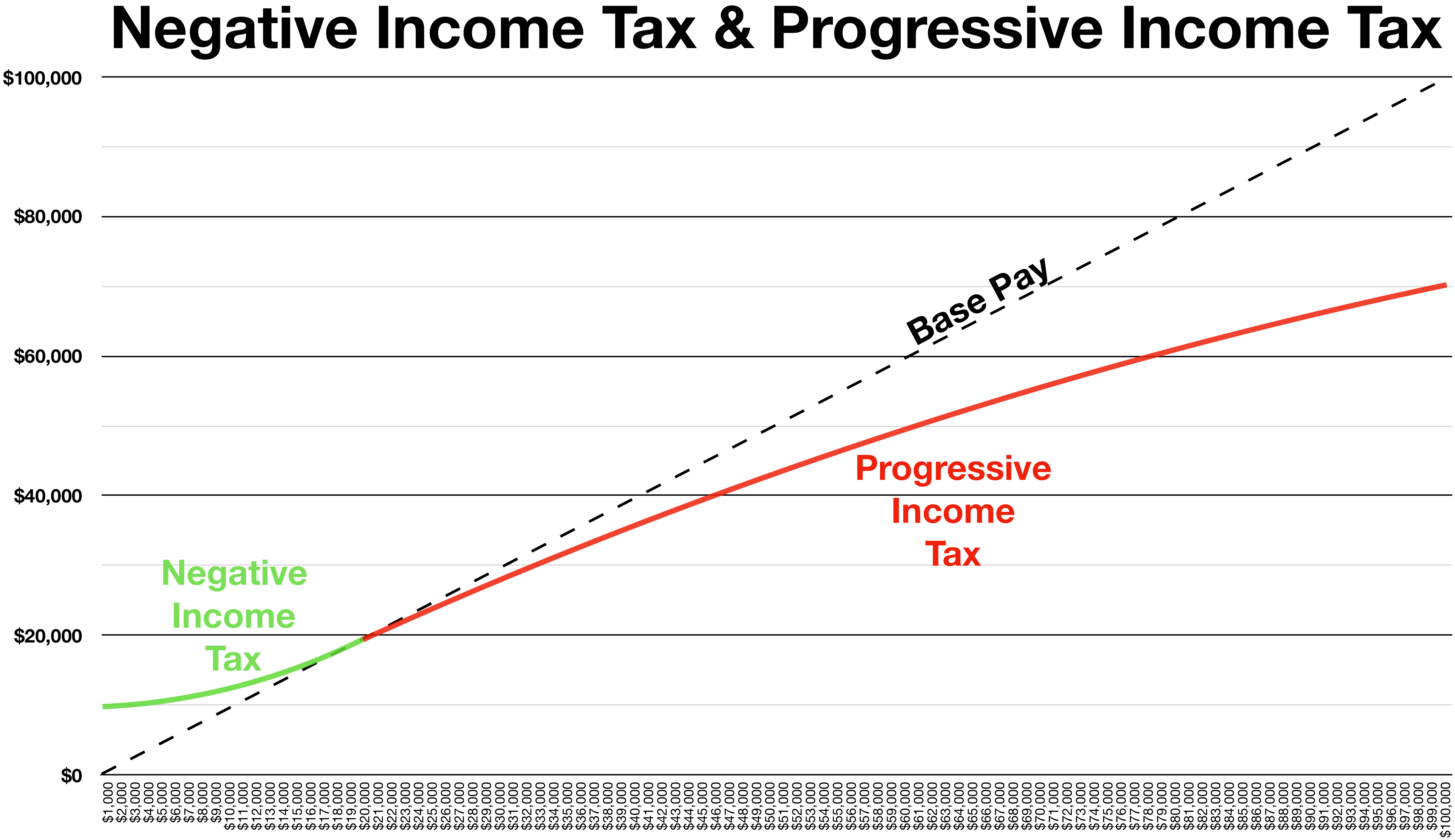

Unfortunately the US-Germany tax treaty doesnt prevent Americans living in Germany from filing US taxes. Progressive rates from 14-45. 1 US-Germany Tax Treaty Explained.

The existing taxes to which this Convention shall apply are. For most types of income the solution set out in the Treaty for US expats to avoid double taxation in Germany is that they can claim US tax credits against German taxes that theyve paid on their income. Over 95 tax treaties.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. 30 for Germany and Switzerland for. Most importantly for German investors in the United States.

The German-American tax treaty has been in effect since 1990. Germany currently has income tax treaties with 96 countries. About Our International Tax Law Firm.

The tax rate is 25 plus solidarity surplus charge of 55 of the tax total flat rate. The income tax treaty dated 1 July 2010 with the United Arab Emirates UAE ceased to. Corporate Capital Gains Tax Rate.

When it comes to real property income the Germany US Tax Treaty provides that any income generated from the real property situated in one of the contracting states may still be taxed in that state in other words for example if a US person resides in the United States and has an income generated in Germany then Germany can still tax the income even though the person is a. However DTTs have not been concluded. Signed the OECD multilateral instrument MLI on July 7 2017.

The tax rate on personal income in Germany varies from 0 to 45. Generally only interest paid by banks to a resident is subject to a WHT. DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE PROTOCOL SIGNED AT BERLIN ON JUNE 1 2006 AMENDING THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND THE FEDERAL REPUBLIC OF GERMANY FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON.

Germany and the United States of America for the Avoidance of Double Taxation and. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page.

WASHINGTON DC The Treasury Department today announced that Deputy Secretary Robert M. Income between EUR 8130 and EUR 52882 is taxed between 14 and 42. The German tax authorities also levy a 55 solidarity surcharge on all income.

Germany has concluded DTTs applicable for income taxes with nearly 90 countries amongst them most of the industrialised countries. The rate is 15 10 for Bulgaria. 1954 and amended by the protocol of September 17 1965.

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in the other Contracting State. German national income tax law has been modified and superseded by various tax treaties with foreign countries to ensure that income is not taxed by more than one country. Us germany tax treaty interest income Wednesday March 23 2022 Kimmitt and Barbara Hendricks Parliamentary Secretary of State Ministry of Finance signed a new Protocol to amend the existing bilateral income tax treaty concluded in 1989 between the two countries.

Aa the federal income taxes imposed by the Internal Revenue Code but excluding the accumulated earnings tax the personal holding company tax and social security taxes. Article 11 2 provides a definition of the term interest. The United States has entered into income tax treaties with more than 60 countries to avoid double taxation of income and to prevent tax evasion.

On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. Individual Capital Gains Tax Rate. Interest paid by US obligors in general Royalties Non-treaty.

The German Federal Ministry of Finance BMF in January 2022 provided information on the current status of Germanys network of income tax treaties and treaty negotiations in annual guidance. 4 Income From Real Property. First to avoid double taxation of income earned by a citizen or resident of one country in the other country.

Taxes In Switzerland Income Tax For Foreigners Academics Com

Double Taxation Oveview Categories How To Avoid

Doing Business In The United States Federal Tax Issues Pwc

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Foreign Companies Expat Tax Professionals

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Sweden Tax Treaty International Tax Treaties Compliance Freeman Law

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

Income Tax In Germany For Expat Employees Expatica

What Is The U S Germany Income Tax Treaty Becker International Law

How To Report Foreign Earned Income On Your Us Tax Return

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

The 7 Best Languages For Business How To Speak Spanish Language Learn Mandarin

Irs Courseware Link Learn Taxes

United States Germany Income Tax Treaty Sf Tax Counsel

Luxembourg Tax Treaty International Tax Treaties Compliance Freeman Law