fresh start initiative expires

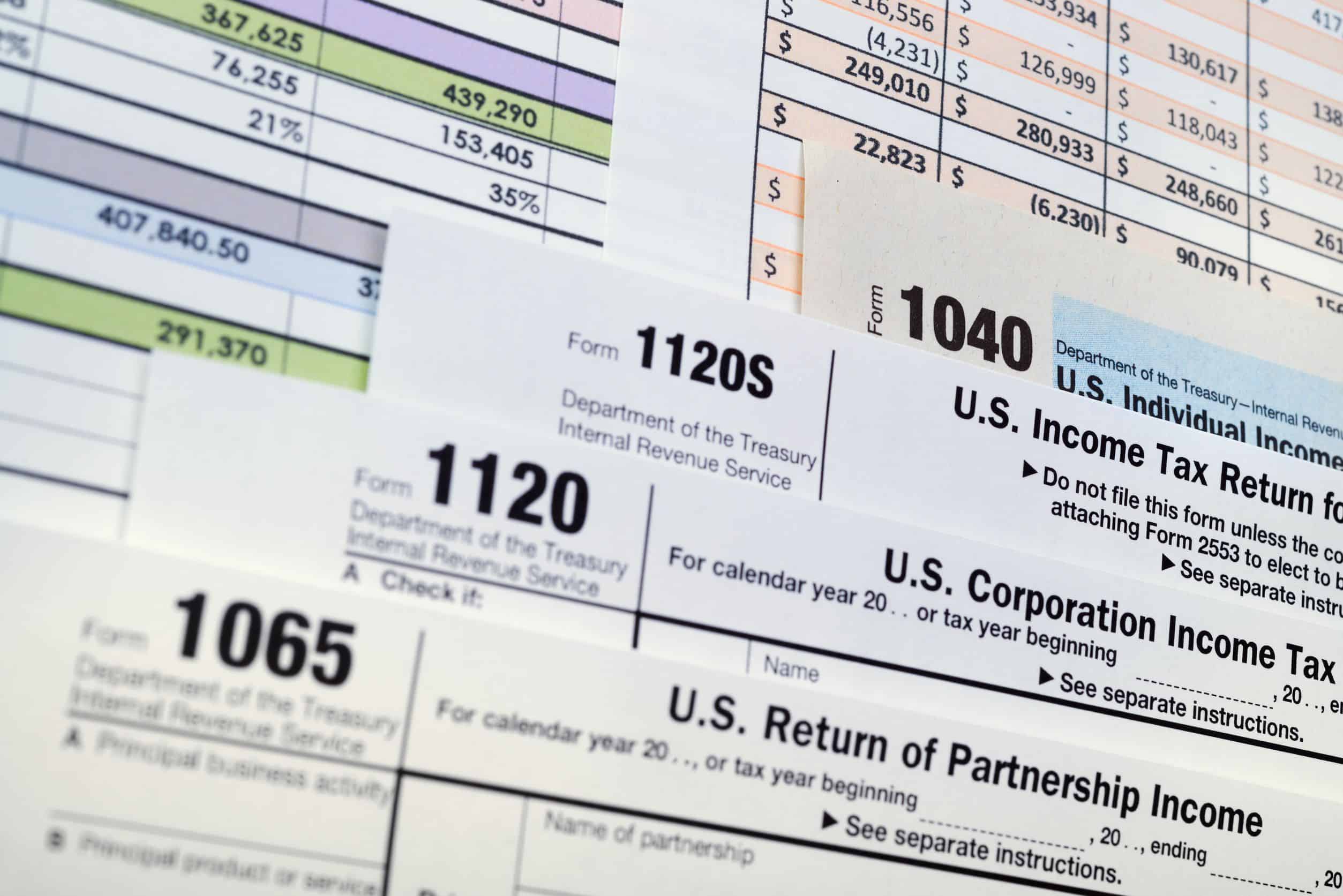

Government in 2011The Fresh Start Initiative Program offers tax assistance to a certain crowd of people who owe the IRS money. The initiativeprogram was initially implemented with the objective of providing taxpayers with a first-time tax liability an opportunity to make things right again by providing expanded options toward securing.

Bankruptcy Fresh Start Program The What And Why Day One Credit

Now with the Fresh Start program taxpayers can pay off their tax debts through the different IRS-approved installment plans.

. Their platform is completely free to use and offers a no-risk consultation. If a taxpayer can pay the outstanding debt within 6-years or the term of the collection statute whichever is shorter the IRS may allow discretionary expenses. The FSI increased the tax debt threshold at.

Promoting the use of generic business planning management techniques. Tax reduction programs under federal law provide real relief but they can be very complexed to navigate. January 6 2022 If you are a US taxpayer or have IRS tax debt you may be eligible for the IRS Fresh Start Initiative.

When the IRS has such a relentless hold on your life its easy to feel utterly powerless. The IRS launched the Fresh Start initiative in 2011 for the purpose of helping more taxpayers to get back in good standing. The 72 month Fresh Start installment agreement must pay all tax periods within the statute.

So in short the Fresh Start Initiative is still in place in 2019. The date at which the tax expires and is no longer legally collectible is. The Fresh Start Program is a collection of changes to the tax code.

GET A FREE TAX QUOTE. Previously referred to as the Fresh Start Program it is now called the Fresh Start Initiative but the primary objective remains the same to give taxpayers with unpaid tax debt more options in which they can become current. This blog post will introduce what the IRS Fresh Start Initiative is about and how it works.

If youre experiencing or worried about liens levies garnishments or more now is the time to learn about your options to protect yourself and resolve your tax burden. Many people wonder if the Fresh Start Initiative is still in place today in 2019. Launched at the Smithfield Show in December 2004 by Sir Don Curry the Fresh Start initiative aims to secure sustainable future for farming in England by.

Promoting an entrepreneurial culture amongst the next generation of farm business owners. The payment option may be as long as 72 months or six years. Before fresh start initiative expires.

The Fresh Start Program also known as the Fresh Start Initiative was established by the US. You can also pay it off within 72 months 6 years under the other option discussed below. The IRS calls these expenses conditional expenses meaning taxpayers can have them allowed on the condition that they pay within 6 years.

As an online aggregator Fresh Start. The fresh start program is a free program and you will not need to pay a fee to participate. A program to forgive a persons tax debt.

In-Business Trust Fund installment agreements. Fresh Start made it clear. Before the Fresh Start Initiative the IRS issued tax liens for all kinds of liability levels.

IRS Installment Agreements. 4 5 Very good Fresh Start Initiatives goal is to help consumers restore control over all of their IRS tax debt issues. Some magical bullet to simply give the IRS a fraction of the tax debt or pennies on the dollar and call it good.

In fact it goes as far back as 2011 but at that time is was referred to as the Fresh Start Program. Instead its an initiative that changed numerous elements of the tax code. The service was established in 2014 and since then has served over 1 million visitors.

In-business trust fund installment agreements are for debts of no more than 25000. The Fresh Start Initiative has its beginnings in 2008 following the recession but has had many additions and modifications over the years. The Fresh Start initiative offers taxpayers the following ways to pay their tax debt.

Expanded Penalty Relief Now expired IRS Fresh Start Tax Lien Changes. Use every day as a way to give your business a fresh start and set your brand apart from your competitors. This is to help willing taxpayers pay off debts without any undue financial hardship.

Our mission is to help you restore your life. The goal of NYSTARTCSIDD is to build relationships and supports across service systems to help people remain in their homes and communities and enhance the ability of the community to support them. A program at all.

The primary provisions of the program included the following. Summing Up on How to Give Your Business a Fresh Start Initiative. Note that there are rare exceptions to this rule.

What Changes Did the IRS Make with the FSI. Soon you will be able to get information from the StudentAidgov website from your student loan servicer or by calling the US. Under the new rules the IRS does not issue tax liens if the tax owed is less than 10000.

That amount is now 10000. Department of Educations toll-free hotline at 1-800-4-FED-AID 1-800-433-3243. The reality is that the Fresh Start Initiative is not new.

If your business is not up to date with the latest digital technology now is the time to embrace the latest developments. Generally the IRS has 10 years to collect the tax from the date of assessment. While there have been changes to IRS procedures after the Fresh Start Initiative was enacted these have generally only served to expand the benefits of the Fresh Start Initiative.

The irs will not retroactively apply the new. The changes made as a part of the Fresh Start Initiative were designed to help. However in some cases the IRS may still file a lien notice on amounts less than 10000.

Generally payments are made until the IRS statute of limitations on collections expires. The term Fresh Start Initiative is more fitting than Fresh Start Program since the Fresh Start Initiative isnt a new program that stands separately from existing tax laws. 72 Month Payment Plan for 50000 or less also known as the streamlined installment agreement.

IRS Fresh Start Qualification Assistance. Services are available 24 hours a day 7 days a week to OPWDD eligible individuals age 6 and over who meet NYSTARTCSIDD eligibility. The program emphasizes facilitating.

It offers varying levels of relief and repayment options based on the specific financial situation of each applicant. The IRS is a fearful agency but they understand that they need to offer taxpayers the opportunity to pay what they can afford while still allowing the taxpayer to care for their needs. It is the federal governments reaction to the IRSs predatory methods which include the use of compound interest and financial penalties to penalize.

Under the fresh start initiative taxpayers can pay their bill over the course of several months and avoid penalties for unpaid taxes and other fees. The Fresh Start program increased the amount that taxpayers can owe before the IRS generally will file a Notice of Federal Tax Lien. As long as you agree to wipe out the debt within the 3 year period there is no set minimum payment per month.

This program allows people to make a one-time payment of their IRS tax debt and avoid penalties and interest. Learn more about the IRS Fresh Start Program here.

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Bankruptcy Fresh Start Program The What And Why Day One Credit

The Irs Tax Debt Forgiveness Program Explained

Federal Tax Lien Statute Of Limitations Mccauley Law Offices P C

How To Find Csed Irs Wilson Rogers Company

Bankruptcy Fresh Start Program The What And Why Day One Credit

What Is The Irs Fresh Start Program 72 Month Installment Agreement

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

Irs Fresh Start Program Guide With 2021 Updates Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Bankruptcy Fresh Start Program The What And Why Day One Credit

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Best Tax Relief Services Top 5 Tax Debt Resolution Companies Of 2022

The Tax Help Guide Ultimate Resource For Tax Help Questions

Bankruptcy Fresh Start Program The What And Why Day One Credit

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

Here S What It Looks Like When A 112 000 Irs Balance Expires Landmark Tax Group

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

Bankruptcy Fresh Start Program The What And Why Day One Credit

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program